GENERAL OVERVIEW

LOGISTICS PRODUCTIVITY NEXUS (LPN)

Logistics Productivity Nexus (LPN) is established under the Twelfth Malaysia Plan

(12MP), which is a government initiative to enhance national productivity and

economic growth through collaboration between the Government, industry players,

and academia. Logistics sector is expected to contribute 6.5 per cent to the national

GDP by the year 2030.

Productivity Growth

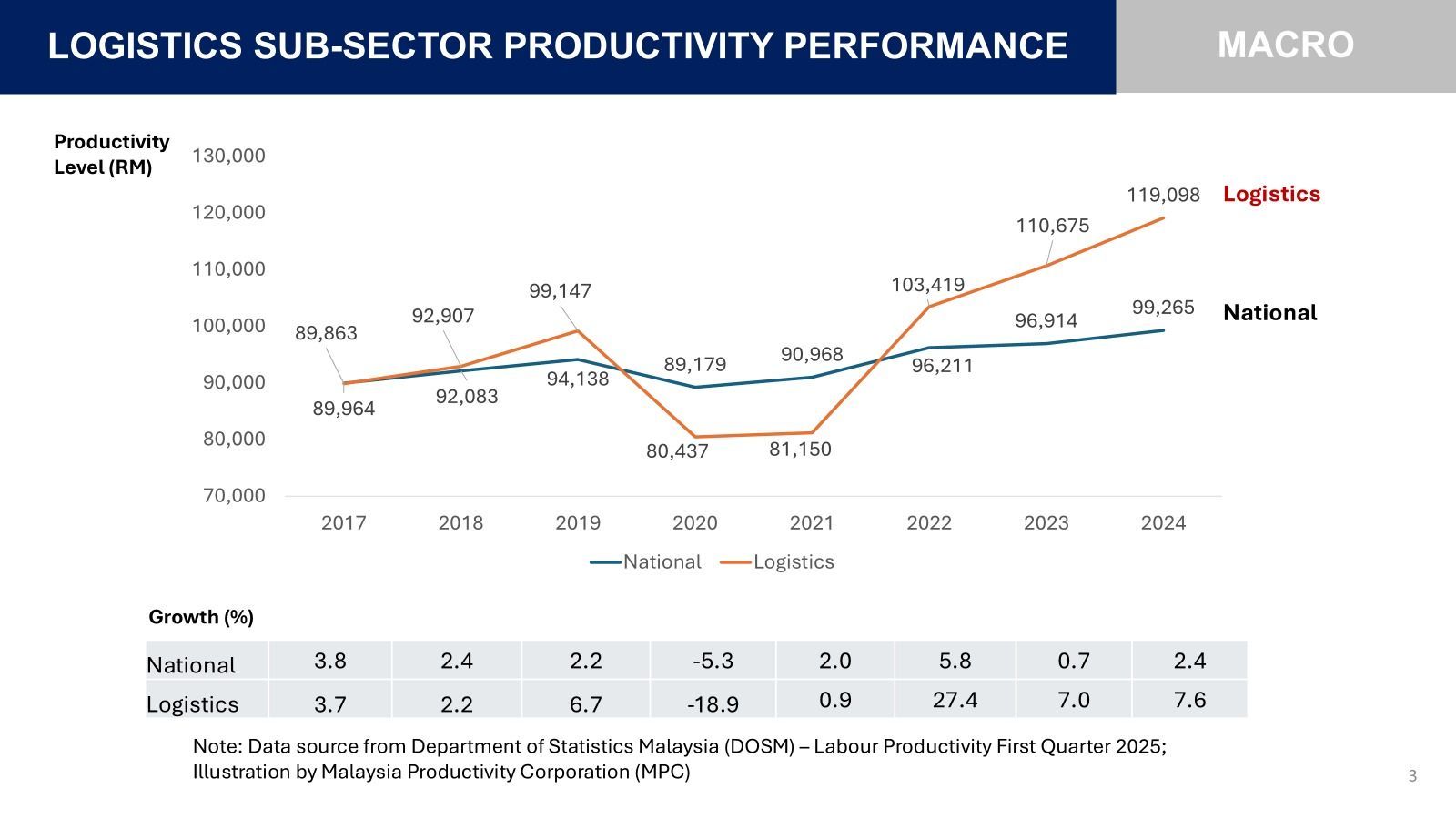

The logistics sub-sector has emerged as one of Malaysia’s strongest productivity drivers, recording a significant upward trajectory from 2017 to 2024 despite pandemic-related disruptions. Labour productivity in the sector increased substantially from RM89,964 in 2017 to RM119,098 in 2024, representing a net gain of RM29,134 which more than triple the national improvement over the same period.

While both national and logistics productivity experienced declines in 2020 due to the COVID-19 pandemic, logistics faced a deeper contraction of 18.9 percent as global supply chains were disrupted and operational capacity was restricted. However, the sector rebounded sharply in 2022 with a remarkable 27.4 percent growth, driven by accelerated digitalisation, e-commerce expansion and strengthened trade activity.

Continued improvements in 2023 and 2024 underscore the sector’s resilience and growing competitiveness. The widening productivity gap between logistics and the national average reaching nearly RM20,000 per worker in 2024, reflects rising value add, increasing technology adoption and enhanced operational efficiency within the sector.

These findings reinforce the strategic importance of logistics as a high impact sub-sector highlighting the need for sustained digital transformation, regulatory streamlining, capability development and ecosystem integration to fully realise its potential under Malaysia’s productivity agenda.

Issue & Challenges

ROAD TRANSPORT:

- Inadequate road infrastructure, especially in Sabah and Sarawak: Unpaved rural roads with few linkages increase travel time and logistics cost

- High vehicle maintenance costs: High costs of vehicle spare parts and maintenance add to overall logistics expenses

- Shortage of skilled drivers: Competitive employment opportunities in other industries lead to driver shortages.

RAIL TRANSPORT:

- Insufficient rail support infrastructure: Lack of cargo handling facilities reduces uptake of rail services.

- Limited rail connectivity to other networks: Poor connectivity to international networks (e.g. China-Laos Rail Link) limits usage

- Cumbersome customs clearance procedures at borders: Complex customs procedures discourage cross-border rail transport

MARITIME TRANSPORT:

- Insufficient port connectivity: Small ports lack capacity and connectivity to support international trade

- Unsupervised levying of onshore auxiliary services: Exorbitant onshore service charges increase overall logistics cost

- High shipping costs between Peninsular Malaysia, Sabah and Sarawak: Cost disparities disadvantages Sabah’s and Sarawak's economies

AIR TRANSPORT:

- High air freight costs: SMEs struggle to afford air transport, limiting market access

- Lack of dedicated cargo facilities for time-sensitive and temperature-sensitive goods: Inadequate facilities lead to delays and potential damage of time-sensitive and temperature-sensitive cargo

CROSS BORDER TRANSPORT:

- Low usage of ASEAN Customs Transit System (ACTS): Lack of awareness about ASEAN transport agreements (such as AFAFGIT & AFAFIST) leads to inefficient processes

- Reliance on traditional cross-border procedures: Traditional procedures increase logistics costs and processing times